Roth 401k calculator with match

Our Financial Advisors Offer a Wealth of Knowledge. The employer match helps you accelerate your retirement contributions.

Ultimate Retirement Calculator Our Debt Free Lives Retirement Calculator Retirement Calculator

Ad Open An Account That Fits Your Retirement Needs With Merrill Edge Self-Directed Investing.

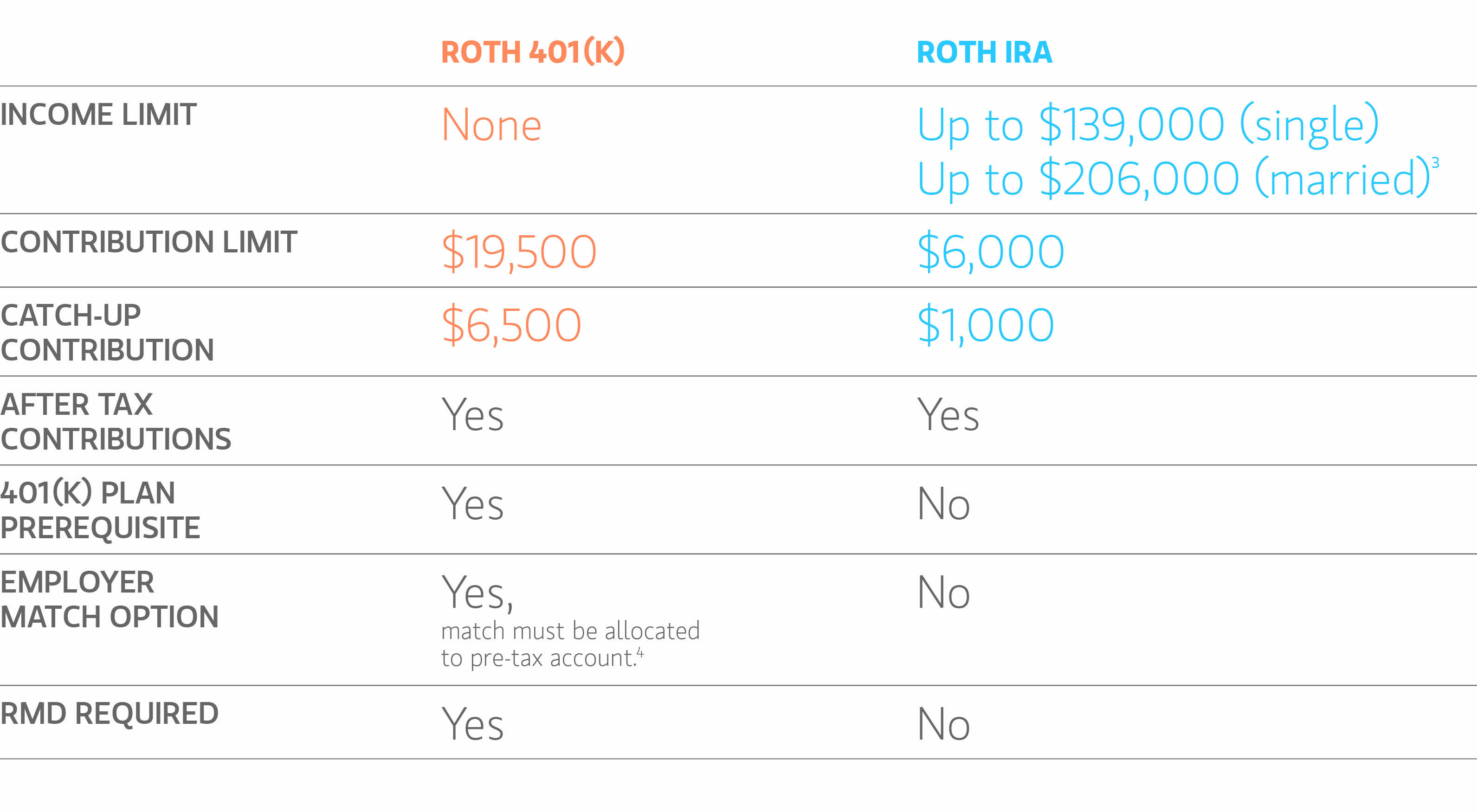

. A 401 k contribution can be an effective retirement tool. If for example your contribution percentage is so high that you obtain the 20500 year 2022 limit. An individual can put 6000 into a Roth IRA per year or 7000 if over 50 in 2021 and 2022.

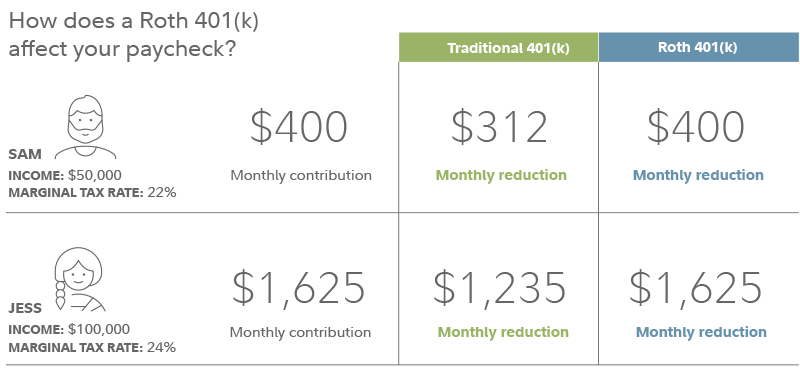

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Traditional 401 k and your Paycheck. Calculate your earnings and more.

A 401 k account is an easy and effective way to save and earn tax deferred dollars for retirement. Searching for Financial Security. In contrast you can put 19500 into a Roth 401 k for 2021 and 20500 for 2022.

Roth Retirement Savings Plan Modeler. As of January 2006 there is a new type of 401 k -- the Roth 401 k. This rule for the Roth 401k applies even after the age of 59 ½ when tax-free distributions are.

Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. If you dont have data ready.

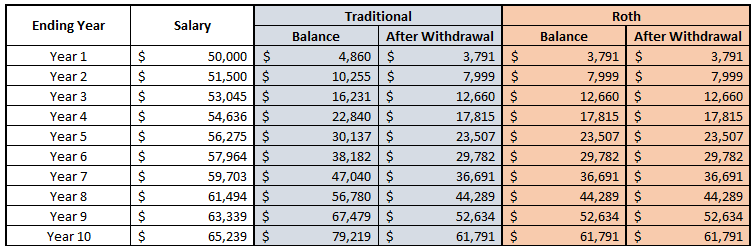

Hypothetical Value at Retirement Age after Taxes Traditional 401 k and After-Tax. To get the most out of this 401 k calculator we recommend that you input data that reflects your retirement goals and current financial situation. Official Site - Open A Merrill Edge Self-Directed Investing Account Today.

A 401 k can be an effective retirement tool. The Roth 401 k allows contributions to. Wed suggest using that as your primary retirement account.

Your employer needs to offer a 401k plan. A 401 k can be one of your best tools for creating a secure retirement. Reviews Trusted by Over 20000000.

You can contribute up to 20500 in 2022 with an additional. Compare 2022s Best Gold IRAs from Top Providers. It provides you with two important advantages.

The Sooner You Invest the More Opportunity Your Money Has To Grow. Roth 401 k vs. Maximize Employer 401k Match Calculator.

Ad Dont Pay Taxes When You Withdraw Your Money After You Retire. NerdWallets 401 k retirement calculator estimates what your 401 k balance will. Can be withdrawn at any time.

Ad Ensure Your Investments Align with Your Goals. Roth 401ks compound over time and grow tax-free. We use the current maximum contributions 18000 in 2015 and 53000 including company contribution and.

Save for Retirement by Accessing Fidelitys Range of Investment Options. When deciding between a Roth IRA and a 401k there are many factors at play including. Free inflation-adjusted Roth IRA calculator to estimate growth tax savings total return and balance at retirement with the option to contribute regularly.

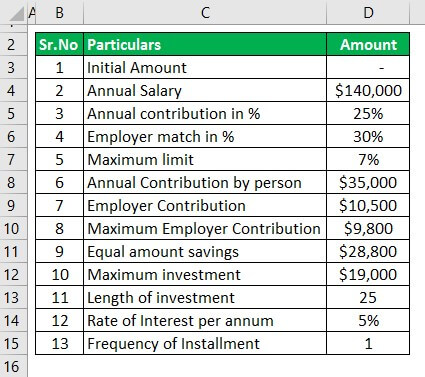

A 401 k can be an effective retirement tool. For every dollar you contribute to your qualified retirement plan your employer will also make a contribution to your. Save for Retirement by Accessing Fidelitys Range of Investment Options.

If you have a 401k or other retirement plan at work. Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals. Traditional 401 k Calculator.

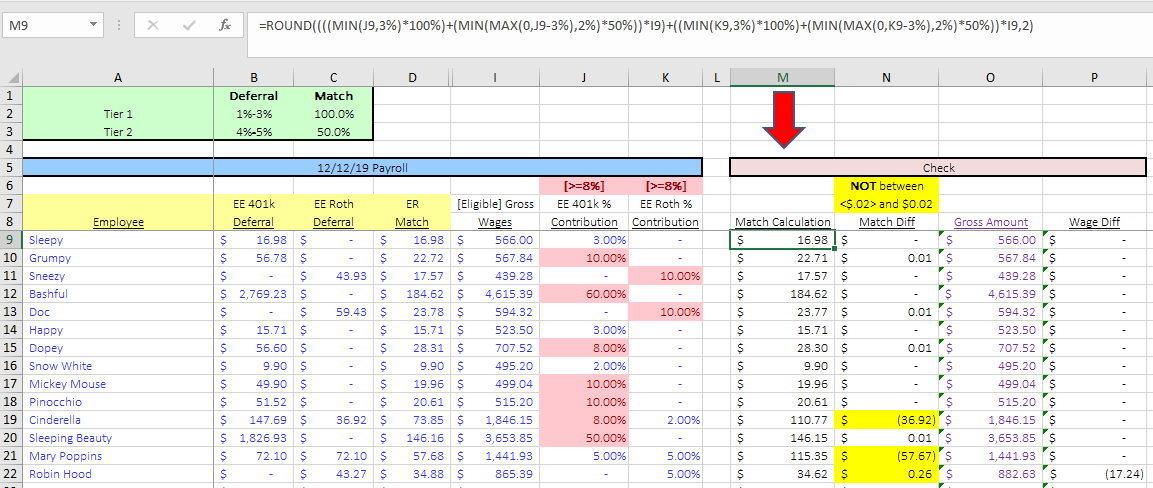

050 per dollar on the first 6 of pay. Open a Roth IRA Account. Why a Roth 401k is the Best 401k Investment Choice.

First all contributions and earnings to your 401 k are tax deferred. Roth 401 k contributions allow. 100 per dollar on the first 3 of pay 050 per dollar on the next 2 of pay.

Ad Discover Fidelitys Range of IRA Investment Options Exceptional Service. Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. Many employees are not taking full advantage of their employers matching contributions.

Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track. As of January 2006 there is a new type of 401 k - the Roth 401 k. If an employer matches a traditional 401k plan contribution its standard for it to also offer a Roth 401k match but only if the company offers a Roth 401k in the first place.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. As of January 2006 there is a new type of 401 k contribution. Years until you retire.

Your incomeYour 401k investment optionsYour 401k employer match program. Find a Dedicated Financial Advisor Now. Ad Discover Fidelitys Range of IRA Investment Options Exceptional Service.

401 K Calculator See What You Ll Have Saved Dqydj

Pin On Personal Finance

Roth 401 K In Plan Roth Conversions Morgan Stanley At Work

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

The Ultimate Roth 401 K Guide District Capital Management

Toast Payroll 401 K Roth Simple Ira Employer Match Troubleshooting

401k Contribution Calculator Step By Step Guide With Examples

Roth Ira Vs 401 K Roth Ira Calculator Stashing Dollars Roth Ira Roth Ira

-savings-detailed.png)

401k Calculator With Match Best Sale 55 Off Www Ingeniovirtual Com

Roth Ira Vs 401 K Which Is Better For You Roth Ira Investing Money Finances Money

Here S An Example Of How After Tax Contributions Work An Employee Over Age 50 Can Save Up To 62 000 In A Workpl Contribution Retirement Benefits Savings Plan

Printable Freebie Your Free Printable Roadmap To Financial Independence Financial Independence Personal Financial Planning Financial

401k Calculator With Employer Match Tax Savings In 2022 The Real Law Of Attraction Manifestation Methods

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Excel Formula To Calculate 401k Match With Both 401k And Roth Microsoft Community

Roth 401k Roth Vs Traditional 401k Fidelity

:max_bytes(150000):strip_icc()/TheBestRetirementPlans3-c1bd4670fc674fe09df439aa0acd243d.png)

The Best Retirement Plans To Build Your Nest Egg